Supercharging the Sri Lankan Economy

We help businesses acquire large volumes of micropayments; reduce the processing fees making the users’ payment experience secure, seamless and convenient.

What is OGO Pay?

Our technology unlocks the full economic potential of the micropayment economy,

through inclusive financial services by reducing card network fees

working with banks, payment processors and merchants

Our technology unlocks the full economic potential of the micropayment economy, through inclusive financial services by reducing card network fees

working with banks, payment processors and merchants

Authorisation Routing

Locally routing payment card details between merchants and issuing banks to reduce acquiring fees for specific segments

Tokenisation

Allowing merchants to store payment card details to process recurring payments with multiple acquiring banks

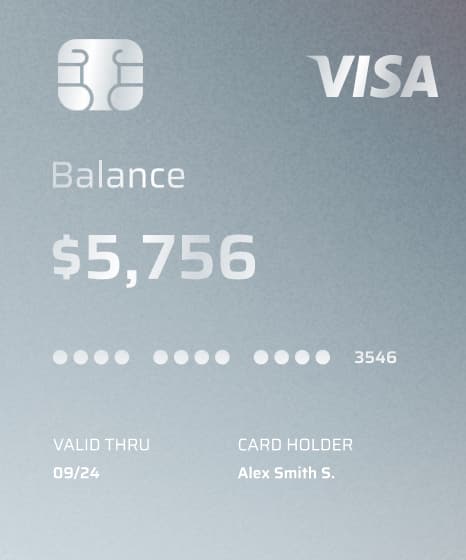

Card Product Portals

Customised web/mobile application development for management of various payment card products

How expensive it is to process micropayments?

Usually, it costs over 5% per transaction.

These could be payments for toll, bus or train tickets or even supermarkets.

High transaction fees have frozen the digitisation of Sri Lanka’s toll and transit networks with over 14 million daily commuters and the general trade retail segment, which is over 50% of island-wide retail outlets.

How do we make it work?

Our technology will locally route payment card details between acquirers and issuing banks; and facilitate recurring payments via payment card storage.

Transit Tickets

Integrate with various transit platforms to process payment cards using multiple methods

Expressway Toll

Integrate with various toll platforms to process payment cards using multiple methods

Convenience Stores

Integrate with various payment processors to process payment cards using multiple methods

Taxi Services

Integrate with various ride-hailing platforms to process payment cards using multiple methods

Subscriptions

Integrate with businesses to enable subscriptions services using payment cards

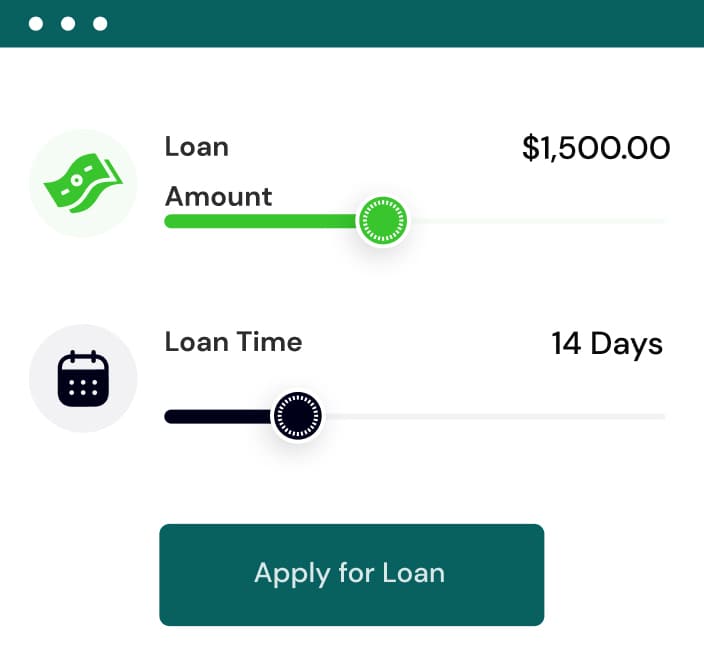

Instalment Payments

Work with banks to provide various management platforms for managing payment card products

We make 1M+ smile, see what they are saying

Loan terms are agreed to by each party before any money is advanced.

A loan may be secured by collateral such as a mortgage or it may be unsecured.

Seevali Wickramasinghe

Brisk has got everything I need. Needless to say we are extremely satisfied with the results. Thank you so much for your help.

Kusal Fonseka

After using Brisk my business skyrocketed! Brisk has got everything I need. Needless to say we are extremely satisfied with the results.

Kalana Dias

The service was excellent. Not able to tell you how happy I am with Brisk. After using Brisk my business skyrocketed!